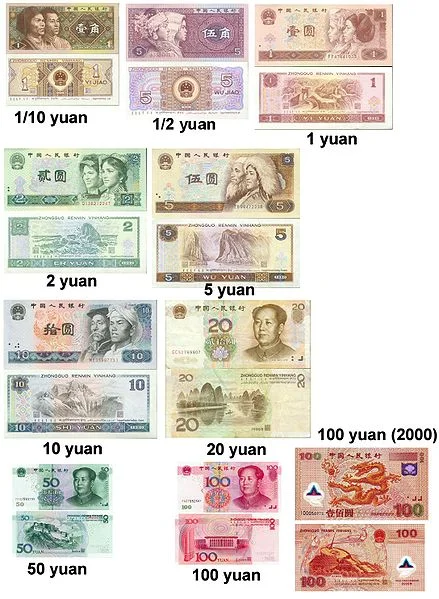

Chinese currency notes

The International Monetary Fund has boosted China’s currency internationally:

November 16, 2015

The IMF is already clearing a berth in its basket of reserve currencies for the Chinese yuan. Once official, the yuan will be the first new currency to be added to the IMF’s special drawing rights (SDR) currency basket since the modern SDR system began in 1981. (The euro replaced the Deutsche mark and the French franc in 1999). The Wall Street Journal hails the approval (paywall) as a “milestone in China’s efforts to establish the country as a global economic power.”

That’s probably overstating things a tad. The re-weighting will boost demand for yuan-denominated assets by at most $40 billion, says Societe Generale. …

Yuan use for trade will likely continue to rise. But once China’s leaders realize that the price of global glory is control, the yuan’s march on international finance centers will surely stumble. http://qz.com/551433/the-yuan-as-a-global-reserve-currency-dont-hold-your-breath/

While China will have issues, and will NOT be the economic leader in this age (the Bible shows that Europe will in Revelation 13,17, & 18), what about the US dollar? Notice the following report:

November 16, 2015

NEW YORK – A decision last week by the International Monetary Fund to accept reserve-currency status for China’s yuan advances a developing plan backed by the United Nations to replace the dollar as the world’s reserve currency.

Last Friday, IMF Managing Director Christine Lagarde endorsed a staff recommendation to include China’s yuan in the basket of four currencies that currently make up the IMF Special Drawing Rights, or SDRs: the U.S. dollar, the euro, the British pound and the Japanese yen. The SDRs play the role of an alternative to the use of the U.S. dollar to settle transactions in international trade.

In a reversal of policy from policy of previous presidents, President Obama has indicated the United States plans to drop opposition to the inclusion of the Chinese yuan in the IMF basket of currencies, giving a green light to anticipated IMF approval of the plan at a meeting of the IMF board Nov. 30.

Today, SDRs issued by the IMF are used typically by IMF member nations primarily as a reserve account to support international trade transactions, not as international currency available to settle international debt transactions in danger of default.

In an important step, the G20 summit meeting in London April 2, 2009, crossed a threshold toward the creation of a global currency through a proposal calling for the IMF to use SDRs to replace the dollar as the world’s reserve currency of choice.

Point 19 of the final communiqué from the 2009 G20 summit in London specified: “We have agreed to support a general SDR which will inject $250 billion into the world economy and increase global liquidity.” It was the first step toward implementing China’s proposal that Special Drawing Rights at the International Monetary Fund should be created as a foreign exchange currency to replace the dollar. http://www.wnd.com/2015/11/global-currency-plan-gets-boost-from-imf/#5MCP51jTWzfjVqP2.99

So, notice that the basic purpose of the SDR program is to dethrone the USA dollar as the world’s reserve currency.

Notice also the following:

November 17, 2015

Leading American financial analyst Warren Pollock has warned that the US will slip into the biggest ever financial depression in the history of the world. http://www.ibtimes.com.au/economic-collapse-big-economies-us-china-may-trigger-war-says-financial-analyst-warren-pollock

November 16, 2015

Get ready for a big change in the global economy. The staff of the International Monetary Fund is now recommendingthat China’s currency be included in the fund’s basket of special reserve currencies. The IMF”s executive board plans to decide on Nov. 30 whether to use the renminbi in calculating special drawing rights.

The U.S. does not seem prepared to focus on the longer-term issues that arise out of the current global competition. The contenders in the 2016 presidential race appear to be oblivious to the looming shadow that faces them. http://www.thestreet.com/story/13366753/1/china-s-renminbi-gets-closer-to-being-reserve-currency-and-changing-global-economic-picture.html

When the USA dollar finally loses its status as the world’s reserve currency, it will be worse than most politicians seem to realize. Expect inflation, interest rate rises, followed by hyperinflation, followed by collapse of the economy of the USA.

The Bible teaches that the USA will end–and the end will come because of international concerns about its debt (Habakkuk 2:6-8), plus the USA relying on military strength and allies that will betray it (Lamentations 1:1-2; Daniel 11:39).

For a long time, the IMF has been concerned that the USA dollar has too much influence in the world and it has been open to ways to change it. The likely addition of the Chinese currency is one step it is looking at to reduce the international financial influence of the USA.

Once interest rates rise a lot, it will be a serious issue for more than the politicians in Washington. It will be a ‘catastrophe’ that will be a factor in the ‘game’ of the USA standard of living being over. And actually it will be worse that that.

The time will likely come when USA interest rates will rise so much that this will ultimately cause a crisis of intense magnitude. The admitted US federal debt (not counting the money created through the quantitative easing programs) is so large that if interest rates rise to the place that they were in the USA in the early 1980s, the USA will have difficulty even paying the interest on the debt it has been accumulating. This will tend to cause interest rates to further rise and contribute to hyperinflation.

Part of the reason that the USA has been able to stave off inflation has been the status of its dollar as the world’s reserve currency. Many US dollars are in banks and other places outside the USA, meaning that they have not returned to the USA to buy goods and services. When those foreigners stop holding the dollars and want to redeem them, inflation will happen. When enough do so, hyperinflation will result.

Which means?

Costs of almost everything in terms of the USA dollar will rise.

Tune in below to listen to more Prophecy News reports

News Presenter: John Hickey